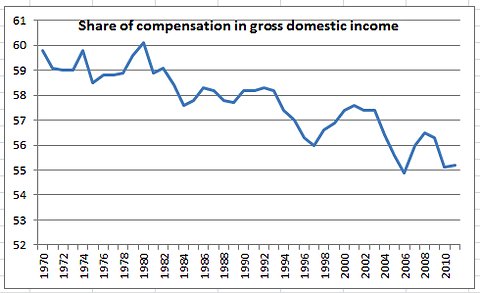

This chart, I think, points to the underlying source of our current economic problems:

It’s from a Paul Krugman post yesterday. It tells us that people are getting an increasing share income from investments, i.e., they’re getting a larger and larger share from investments than from compensation they receive for working. Not good news if you don’t have money to invest.

PK notes in his post:

I think our eyes have been averted from the capital/labor dimension of inequality, for several reasons. It didn’t seem crucial back in the 1990s, and not enough people (me included!) have looked up to notice that things have changed… And it has really uncomfortable implications. But I think we’d better start paying attention to those implications.

I’d say lots of people have noticed the trend. (Welcome, Paul!) Heck, I’d say that Perot foresaw it back in 1992 when he made his “giant sucking sound” comment. Since at least Reagan’s presidency the trend in government policy has been to favor capital over labor. PK’s chart reflects the effects of said policies.

Update:

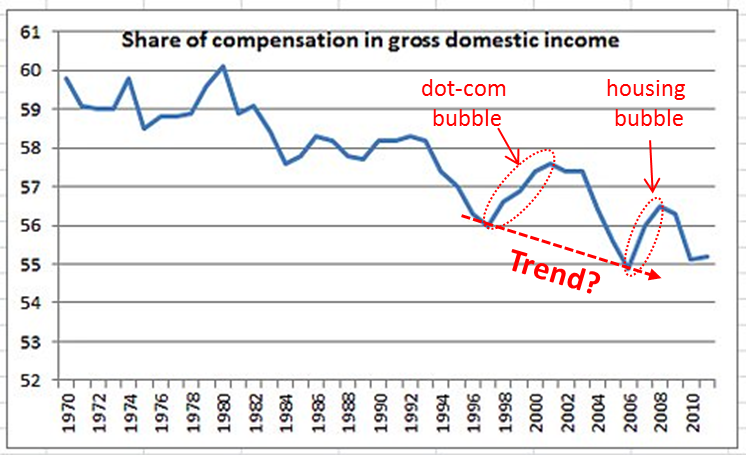

I look a little more at the data and I see this:

Okay, so what I’ve marked as “housing bubble” isn’t quite right – run up started ca. 2001 – but the rises and falls over the past 15 years or so do make me wonder what effects the bubbles had on workers’ compensation. We know Trickle On Down economic doesn’t work but perhaps people who work for a living don’t get screwed as badly during booms/bubbles? A comforting thought…