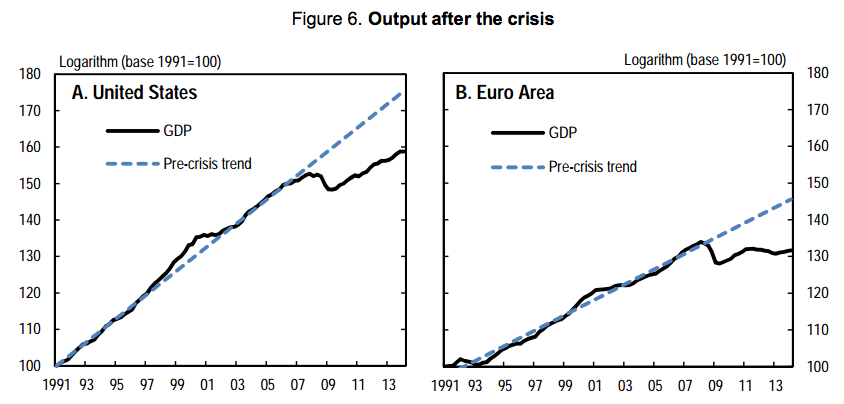

Brad DeLong points us to Matt Yglesias, The US recovery has been a disaster; the eurozone’s has been much worse:

As this chart from the OECD’s new report on the US economy shows, the economic recovery in the United States has been incredibly weak.

But it’s also been enormously stronger than the recovery in the eurozone. If you want to know whether things like the 2009 stimulus bill and the various iterations of quantitative easing have worked, this is the comparison you need to look at. Have they worked to make the economy healthy? No. Have they worked to make the economy healthier than it’s been in the place where they didn’t do that stuff? Absolutely.

There’s no such thing as a well-controlled experiment in macroeconomics. This is about as you’re ever going to see. The US enacted a modest stimulus. In contrast, Europe went all in for austerity. Modest stimulus won.