[The left] should be offering solutions to uncertainty – a stronger better social safety net and a job guarantee. We should also be offering people real control over their lives – and not control exercised on their behalf by the sort of elites they profess to despise.

Category Archives: Economics

Happy Tax Day

Okay, it’s not quite Tax Day yet but if I don’t post this now then I’m likely to forget.

John Scalzi in 2010, Tax Frenzies and How to Hose Them Down:

A question in e-mail based on all the recent “rich people feeling not rich” nonsense, and the associated commentary online:

Why is it that the people freaking out the most about taxes on the rich are the ones who don’t seem to know how the tax code works?

The answer is in the question: Because they don’t know how the tax code works. The major failing seems to be an incomprehension regarding marginal tax rates, but people also seem to fall down on the matter of taxable income vs. gross income (i.e. how deductions can work for you!), how to apply tax credits, and other various and fairly basic aspects of the tax code here in the US.

If you don’t know that stuff — if you basically wander through your life thinking the government taxes all of your income based on the highest possible percentage — then I suppose it’s no wonder you freak out. But it also kind of makes you the financial equivalent of the people who think that Darwin said we are all descended from monkeys, or that the Bible says “God helps those who help themselves.” In short, it means you’re a bit ignorant. You should stop being that. It’s easily correctable. In any event, at some point in time, real live grown-ups should understand the concept of marginal rates. It’s not that difficult to grasp.

Thought for the Day – March 28, 2016

All businesses should be employee-owned.

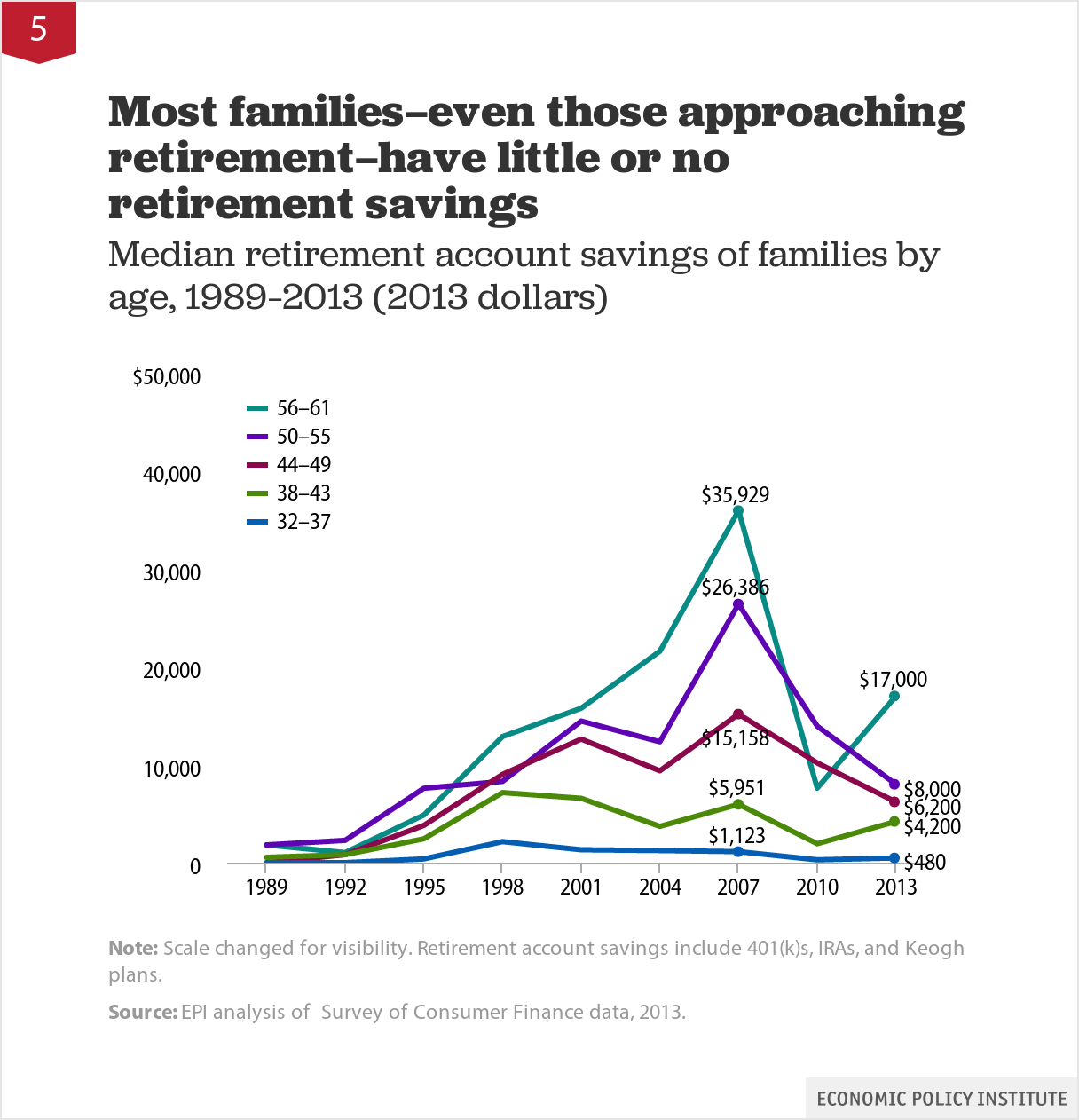

In case you forgot that Social Security is an anti-poverty program

Thought for the Day: February 26, 2016

I think it’s fair to say that a common goal of Sanders supporters is a more democratic distribution of political power. The wealthy hold a disproportionately large share. (Has it ever been otherwise?) That needs to change. To the extent that Sanders supporters embrace heterodox economics (I don’t particularly) I’ll hazard that it’s as part of an overall approach to creating a more democratic and equitable society. Many things influence quality of life. The macroeconomic climate is one them. With respect to recent arguments over what Sanders’ plan would do for GDP growth, I doubt that I would support a candidate whose economic policies who likely lead to economic contraction – of the countries I might care to live in if I couldn’t live here, I don’t believe any have had a contracting GDP on a regular basis – but so long as the trend is upward I don’t think I care too much about the details. Positive is good but more isn’t necessarily better. To the extent that economic considerations are a priority for me, I’m much more concerned about how economic gains are distributed, opportunities for gainful employment, job stability, and that I’m compensated fairly than I am about the particulars of GDP growth.

Critique vs analysis: Macroeconomic modeling edition

UC-Berkeley economists Christina and David Romer have provided a detailed evaluation and critique of Gerald Friedman’s analysis of predictions of the economic effects Senator Sander’s economic plan. Their Conclusion:

The bottom line of our evaluation of Professor Friedman’s analysis is that it is highly deficient. The estimated demand – induced effects of Senator Sanders’s policies are not just implausibly large but literally incredible. Moreover, even if they were not deeply flawed, Freidman’s enormous estimates of demand – fueled growth could not and would not come to pass. Even very generous estimates of the amount of slack still present in the American economy would not be enough to accommodate demand – driven growth of anything near what Friedman is estimating. As a result, inflation would soar and monetary policy would swing strongly to counteract them. Finally, a realistic evaluation of the impact of Senator Sanders’s policies on productive capacity (something that is neglected in Friedman’s analysis) suggests that those impacts are likely small and possibly negative.

Though we have been frankly critical of Professor Friedman’s analysis, he has provided a service to public debate by posting his analysis so that other economists can evaluate its validity. We are posting our evaluation in the same spirit.

They provide ample basis for their conclusion that Friedman’s predictions are overly optimistic but leave several important questions unanswered.

“A democracy is not a graduate seminar.”

Steve Randy Waldman, Your theory of politics is wrong:

I support Bernie Sanders in the Democratic primary. I don’t support Sanders because I think he is brilliant in some academic way. I don’t support Sanders because I am particularly impressed with the details of his policy proposals, although they are not nearly as hopeless as some self-proclaimed technocrats make them out to be. A democracy is not a graduate seminar.

The Plausibility of 5% Annual GDP Growth

I still remain skeptical that GDP Growth >5% is likely if were to adopt Sanders’ economic program – or any other candidates economic program. I’m skeptical but I no longer think it’s ridiculously optimistic. I’d call it fairly optimistic but not extremely so. (If you’re just tuning in, the context here is that UMass economist Gerald Friedman predicting the Sanders’ economic plan could boost GDP growth to 5.3%. Some well-respected economists responded that 5.3% growth is nuts. The debate is ongoing.) Why has my outlook changed? Because I’ve read pieces by reality-based economists arguing that 5% is entirely plausible. “Plausible” doesn’t mean that it would happen. It means that it’s not unreasonable to believe that it could. Here are the links:

- Narayana Kocherlakota, Faster Growth IS Possible – And It May Well Be Desirable

- Narayana Kocherlakota, How Cheap Labor and Capital Suggest that Faster Growth is a Great Deal

- James Galbraith, Response to former Council of Economic Advisors Chairs

- J.W. Mason, Can Sanders Do It?

I maintain that Sanders’ principal merits as a candidate have little do with what his proposals might do for economic growth but it’s worth noting that it seems reasonable to believe that they could have a strong positive effect.

GDP will take care of itself

I noted yesterday that there is much fussing in housebroken liberal circles about UMass economist Gerald Friedman’s prediction that, if implemented, Sanders’ economic agenda would cause GDP growth to rise to 5.3%. That’s higher than the yearly average has been since prior to WWII. Friedman defends his prediction here. Former MN Fed President Narayana Kocherlakota, a reality-based individual, implies that it’s not a ridiculous number:

Professor Gerald Friedman has argued here that, by adopting Senator Bernie Sanders’ economic proposals, the US economy would grow in excess of 5% per year over the next decade. Previously, former Governor Jeb Bush put forward (different) proposals that he has argued would lead to 4% economic growth over an extended period. These kinds of growth outcomes are often dismissed as prima face unachievable given the historical behavior of the US economy. (That’s one way that some readers have interpreted this letter.)

I don’t attempt a full examination of Senator Sanders’ or Mr. Bush’s proposals in this post. Rather, I make three points related to this discussion that don’t receive sufficient attention:

-

There is no technological reason why real gross domestic product (GDP) cannot grow at a materially above-normal rate over the next decade

-

Given (1), the relevant issue is: are the benefits of achieving such a growth path higher than the costs of doing so? I suggest that there are good reasons to believe that the answer to this question is more likely to be positive than at any time since the end of World War II.

-

If the answer to (2) is affirmative, the question becomes: what set of economic proposals will best allow the country to achieve those positive net benefits? As noted above, I don’t attempt a detailed examination of the consequences of Senator Sanders’ proposals or those of Mr. Bush. I only make the broad point that, given current economic circumstances, demand-based stimulus is likely to be more effective than supply-based stimulus.

I think that’s an excellent frame. Based on how the US economy has performed over recent decades, I remain skeptical of being able to hit 5.3% with Sanders’ or anyone else’s plan but I believe Kocherlakota is right, there’s no technological reason why GDP can’t grow at a much higher rate than it has been. There are huge political hurdles and technical challenges to generating that kind of growth but that doesn’t mean it can’t be done. And even if 5.3% isn’t in the cards I do believe we can do much better than we’ve done. We’re at about 2% now. Would we not be happy with 4% or even 3%?

Whether or not it’s theoretically possible to hit 5.3%, one argument against putting that number forward is that it smacks of delusional optimism and that’s not good practice. A serious candidate should not adopt implausible policy positions [see Note 1 below]. I concur. I also believe that whether Sanders’ economic plan would generate 5.3% growth or 3.5% or 2% growth is beside the point. His campaign isn’t about goosing GDP, it’s about changing the rules of the game. I doubt there are many Sanders supporters who are with him because of an expectation of any particular GDP growth rate. It’s about changing the power dynamic to improve the quality of life for most Americans.

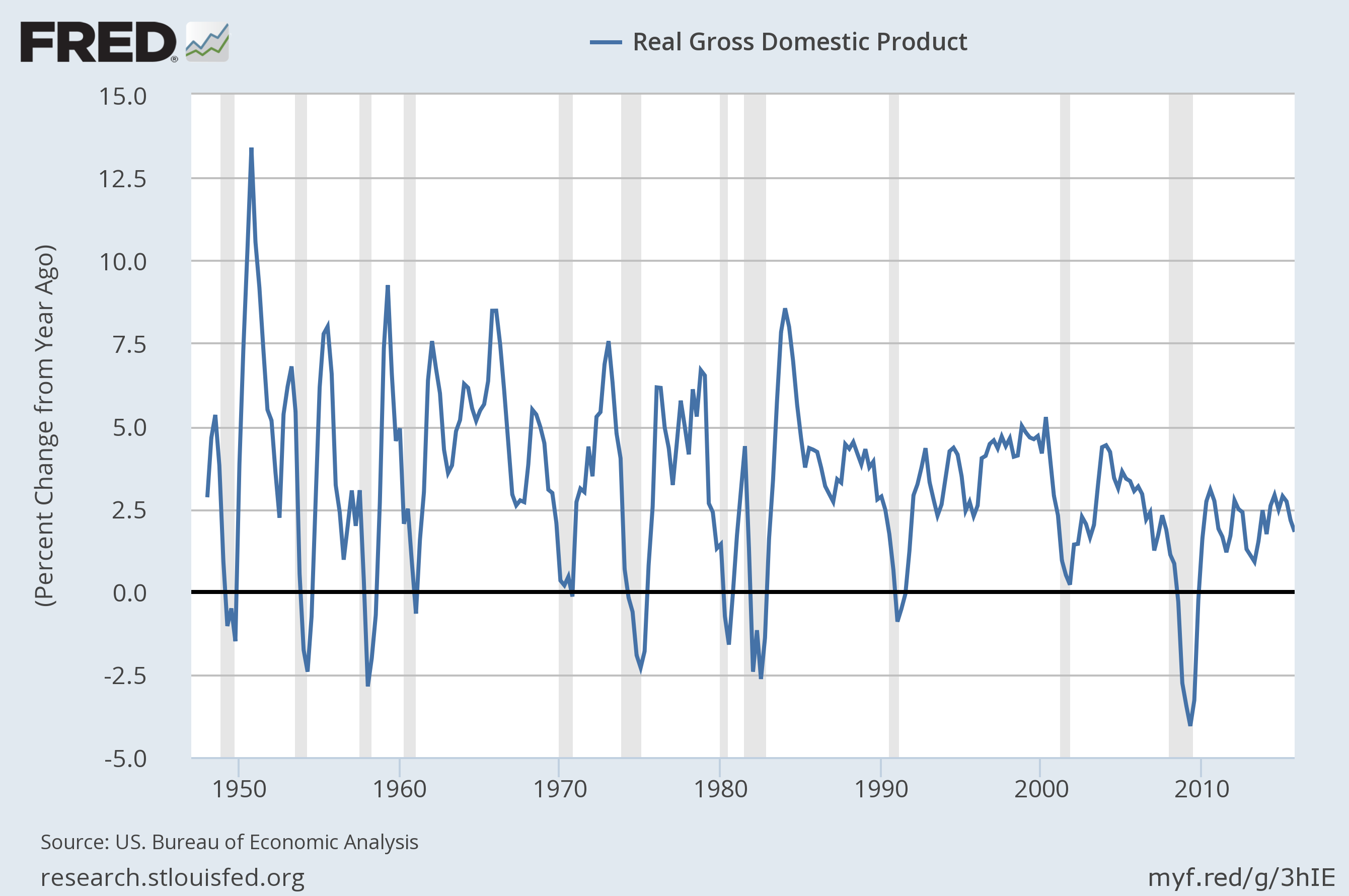

U.S. Real GDP Growth

From the St. Louis Fed, here’s the annual growth in real (inflation-adjusted) U.S. Gross Domestic Product since 1947:

UMass economist Gerald Friedman predicts that, among other things, Bernie Sanders’ economic plan will raise GDP growth to 5.3%. That’s very high by contemporary standards and his prediction has caused a major kerfuffle within housebroken liberal economist circles – see also here. We haven’t had GDP growth that high since the early ’80s when we were coming out of a severe recession. As you can see from the chart, prior to that GDP growth >5.3% was a pretty regular occurrence. Can we make it a regular thing again? I’m not sure but I’m skeptical. The world is very different now than it was 35, 40, or 50 years ago. (That was pre-globalization. We had a manufacturing advantage of much of the rest of the world.) 5.3% growth now seems like a stretch. That’s a factor of about 2.5x over current. Still, if Sanders was able to enact his platform (perhaps during his second term after people who support it take the majority in the House and Senate;-) and growth were even half of what Friedman predicts that would be a significant improvement over current.