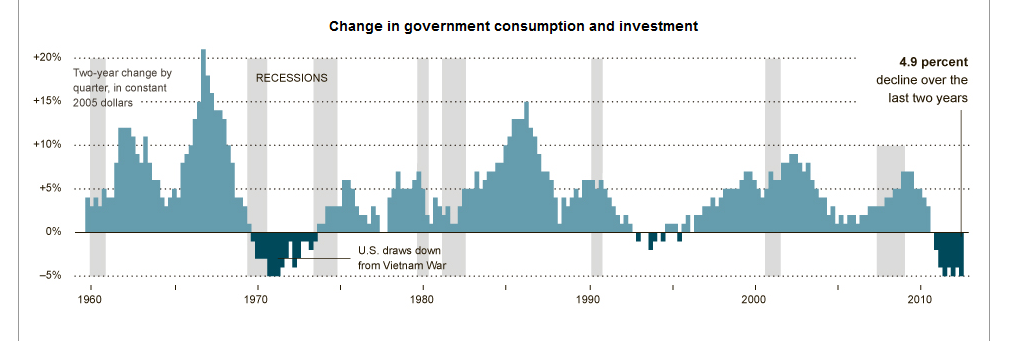

From the NY Times, Austerity Kills Government Jobs as Cuts to Budgets Loom:

The chart is a bit difficult to read here. Click through to the article for a better view. The bottom line: Contrary to what you may be hearing in the popular press and around the watercooler, government spending investment and consumption* has contracted over the past several years – almost 5% over the past two years. That contraction is one of the reasons for the anemic economic recovery since The Great Recession kicked in. Doubling down on those cuts will only exacerbate the problem. From the article (emphasis added):

The Federal Reserve and other economic forecasters say that the latest round of government austerity is not likely to return the economy to recession, thanks to stronger private sector growth. But the spending cutbacks and actions to raise taxes could reduce growth by roughly 1.5 percentage points this year, according to the Congressional Budget Office, leaving the sluggish economy operating well below capacity.

In testimony to lawmakers on Tuesday, the Fed chairman, Ben S. Bernanke, urged Congress and the Obama administration to replace the scheduled budget cuts with a plan to reduce federal deficits more gradually.

“Although monetary policy is working to promote a more robust recovery, it cannot carry the entire burden of ensuring a speedier return to economic health,” Mr. Bernanke said. He warned that the combination of previous spending cuts and the looming mandatory reductions “could create a significant headwind for the economic recovery.”

Bernanke’s comment is an excellent summary of why implementing austerity measures now is a lousy idea. To wit:

“The boom, not the slump, is the right time for austerity at the Treasury.”

– John Maynard Keynes (1937) Collected Writings

* I infer from paragraph five of the article that “government consumption and investment” does not include Social Security. I presume it doesn’t include Medicare either. Unemployment benefits? I don’t know. I have an email out to Mr. Applebaum, the NY Times’ reporter, asking for clarification. The Times’ reporter, Binyamin Applebaum, informs me that the number comes from the Dept. of Commerce’s Bureau of Economic Analysis. If you go to the BEA page there’s lot of data and other info available. I found the NIPA Tables particularly informative.

Update based on looking at some NIPA tables:

Defense spending: 1) is a big driver of GDP and 2) has been all over the place for the past five quarters. For example, it rose 13% from Q2 to Q3 of 2012 and then dropped 22% from Q3 to Q4. (?!?) That translated to +0.6% and -1.3% impact on GDP. (To put those numbers in perspective, overall the GDP grew 3.1% from Q2 to Q3 and shrank 0.1% from Q3 to Q4.) If you look at 2011 and 2012 combined, real GDP increased 4.0% but Defense spending fell 5.7%. This probably isn’t a legit comparison but if Defense spending had held constant for 2011-2012, the GDP would have grown 2.5x faster than it did. (I suspect that 5.7% drop is due to wind down in Iraq, but imagine if those dollars had been invested elsewhere? And, yes, economic conditions are such that if the govt had made such an investment it almost certainly would have made its (our) money back.) Anyhow, Defense spending is a major factor in our economy.