Paul Krugman, Love for Labor Lost

Originally, believe it or not, Labor Day actually had something to do with showing respect for labor. Here’s how it happened: In 1894 Pullman workers, facing wage cuts in the wake of a financial crisis, went on strike — and Grover Cleveland deployed 12,000 soldiers to break the union. He succeeded, but using armed force to protect the interests of property was so blatant that even the Gilded Age was shocked. So Congress, in a lame attempt at appeasement, unanimously passed legislation symbolically honoring the nation’s workers.

It’s all hard to imagine now. Not the bit about financial crisis and wage cuts — that’s going on all around us. Not the bit about the state serving the interests of the wealthy — look at who got bailed out, and who didn’t, after our latter-day version of the Panic of 1893. No, what’s unimaginable now is that Congress would unanimously offer even an empty gesture of support for workers’ dignity. For the fact is that many of today’s politicians can’t even bring themselves to fake respect for ordinary working Americans.

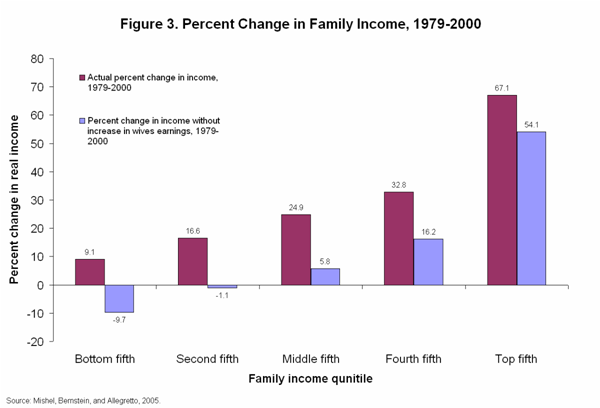

Percent Change in Family Income

Interview with Amelia Tyagi, The Two-Income Trap

Jared Bernstein, Wage Stagnation and Market Outcomes

Jared Bernstein, The Audacity of the Fight for Higher Minimum Wages

David Leonhardt, ‘The Great Shift’: Americans Not Working

Dean Baker, Labor Economics 101: Few Jobs Means Bad Jobs

St. Louis Fed, After-Tax Corporate Profits

Dean Baker, Scary Thought on Labor Day Weekend:

Ezra Klein gives us some terrifying news in a Bloomberg column today. President Obama’s economic team think they are doing a great job, hence the desire to bring back former teammate Larry Summers as Fed chair. This is terrifying because the economy this Labor Day is described by a set of statistics that can only be described as horrible.

We are almost 9 million jobs below the trend level of employment. The number of people involuntarily working part-time is still up by almost 4 million from its pre-recession level. Wages have been stagnant for a decade and show no signs of increasing any time soon. And, according to the Congressional Budget Office, the economy is still operating more than $1 trillion (6 percent) below its potential. Oh, and by the way, the financial sector is more concentrated than ever, with top honchos drawing the same sort of paychecks they did before the crisis.

Mark Thoma following up on Baker’s complaint:

I believe the Fed should do more, that it could help some, but I am also doubtful about how much more the Fed can accomplish in helping with the unemployment problem. What we need is sane fiscal policy, that’s what could really help the unemployed, but instead we are focused on the Fed chair, dividing economists into camps, etc. We need fiscal policymakers to be in the macroeconomics camp rather than the political/ideological camp that is driving things like austerity, potential government shutdowns over manufactured crises, worries about the debt used to push for smaller government, and so on that are harming the recovery.